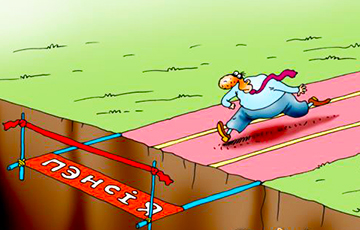

Retirement Age Is To Be Raised Soon

149- 15.05.2017, 8:22

- 31,765

The next stage of the "reform" is inevitable.

The current pension reform solves the problem of the pension fund deficit only until 2022. After this, a new reform is to be required, which can be expressed in the next increase in the retirement age.

Such conclusions are contained in an article written by researchers Katsiaryna Lisiankova and Katsiaryna Barnukova "The Effects Of The Population’s Aging On The Pension System Of The Republic Of Belarus", published in the scientific Baltic Journal of Economics.

The demographic situation leads to an increase in the deficit of the pension fund

We remind that the increase in retirement age has started in Belarus this year. Annually, it will be increased by half a year, until it reaches 58 years for women and 63 years for men. This process will be completed in 2022.

"We’ve figured out how the pension fund is to be filled. It turned out that its deficit could be kept at an acceptable level, that is, below 1% of GDP, only until 2022. After that, the deficit will grow," – Katsiaryna Barnukova, an expert of the Center for Economic Research of BEROC, tells in her interview to Thinktanks.by.

The expert recalls that the deficit of the pension fund was first formed in 2014. "Before that, there had been no deficit due to the favorable demographic situation for the pension system. In the early 2000s, there was a generation of war children in retirement, the number of pensioners was small, and the baby boomer generation of the 1980s came to the labor market at that time. Now the situation is changing: people, who were born during the post-war baby boomer period, become pensioners, and the generation of the 1990s, the period of a sharp decline in the birth rate, enters the labor market.

Now, young people are only partially replacing the retired people on the labor market. The employment is falling, contributions to the pension fund are decreasing because of that, while the number of pensioners is increasing," – Katsiaryna Barnukova explains.

The situation is so bad that the state does not even comply with the legislation requirement to index the pension in accordance with the level of the average salary. Both in 2015 and in 2016, pensions were reduced faster, that is, they were not indexed in full or in part.

The deficit of the pension fund can put the country in front of the need for new foreign borrowings

Raising the retirement age is a quick way to solve the problem of the deficit of the pension fund.

"In general, such a decision makes sense: the life expectancy is constantly growing, and many people, reaching retirement age, are eager to continue working," – Katsiaryna Barnukova says. According to the expert, the current increase in the retirement age for three years will allow to keep the deficit of the pension fund within 0.5% of GDP for several years.

"However, after the reform is over, the deficit will start to rise again. By 2035, the deficit could reach 2% of GDP. As soon as the deficit exceeds 1%, which, according to our calculations, will occur in 2025, the situation will become critical for the budget. In order to find the necessary funds, it will be necessary to increase the external debt. It will not be easy to do it, because Belarus has already used up the borrowing possibilities: today we have to borrow money to repay the old debts," – Katsiaryna Barnukova says.

We should expect a new stage of the pension reform

This means that a new stage of pension reform is imminent in the near future. "According to our calculations, the only scenario for maintaining the pension fund with an acceptable deficit until 2040 is to raise the retirement age up to 65 years for both men and women," – the expert says.

Commenting on the possibility of solving the problem by introducing a system of private pension funds, Katsiaryna Barnukova notes a number of problems:

"Alternative ways of retirement savings should be developed even as we speak. But unfortunately, if people give only part of the contribution to the pension fund, and part of it transfer to savings for their own pension, there will be no money to pay pensions today. The second problem is connected with the fact that the stock market is absolutely not developed in Belarus. Traditionally, pension funds make quite conservative investments in stocks and bonds. In our country, there are no necessary tools for that."