New Devaluation Appears On Radars

12- 20.09.2017, 13:49

- 108,393

The Belarusian ruble seems to enter the storm belt.

Despite the relative stability in the Belarusian foreign exchange market, in the summer of 2017, there were signs of a revival of devaluation expectations among the population and enterprises of the country, which have high chances to become true, Uladzimit tarasau writes for the website of Belrynok.

Over the past months, Belarus' currency reserves have grown significantly, the dollar exchange rate has fluctuated in a rather limited range, the balance of foreign trade has improved. It might seem that in such conditions the attractiveness of the Belarusian ruble as a saving currency should be growing, and the population and enterprises should get rid of foreign currency. However, there have been signs of the formation of the opposite trend in our country recently. First of all, they showed up in the market of foreign currency deposits.

The people no longe take foreign currency from the banks

The first sign of the growth in devaluation expectations was that the population practically stopped withdrawing funds from time foreign currency deposits this summer, as a result of which their value stabilized (figure 1). In particular, the amount of time foreign currency deposits of Belarus decreased in August after a slight increase in July, however, by a fairly symbolic amount: 0.8 million USD (0.01%), reaching 6.806 billion USD as of August 1.

Moreover, since the beginning of the year, the amount of transferable foreign currency deposits of the population, that is, basically, their funds on bank cards, has been growing at approximately constant rates, and has increased by about one and a half times in eight months (Chart 2). This value in August increased compared to July by 19.8 million USD (3.3%) and amounted to 617.1 million USD. That is, people keep currency funds on cards, which provides convenience of settlement abroad, but do not seek to transfer funds to time foreign currency deposits.

In itself, this process reflects not so much the devaluation expectations, as the growing popularity of non-cash settlements in foreign currency and the reduction in the attractiveness of time deposits due to the falling rates on them.

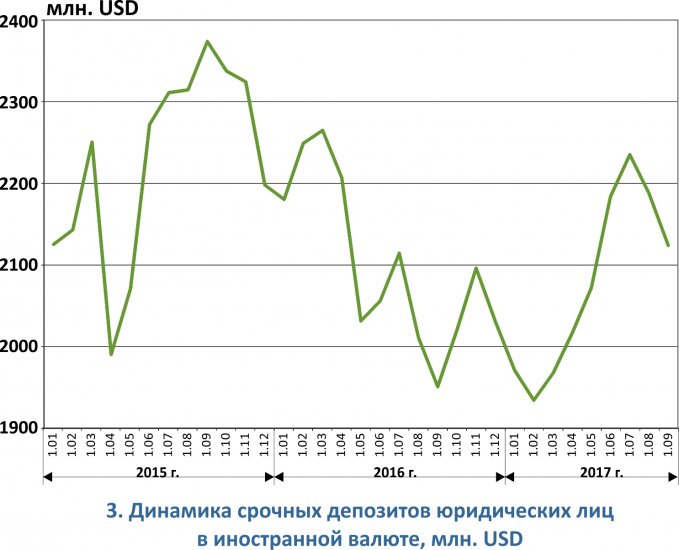

Legal entities since the beginning of 2017 have accumulated currency on their time deposits in banks, although in the last two months the value of these deposits has slightly decreased (figure 3). In particular, in August - by 64 million USD (2.9%) - up to 2.124 billion USD.

Thus, legal entities, like physical persons, clearly increased the propensity to save money in foreign currency. Of course, this process with regard to enterprises is explained, to a greater extent, not by devaluation expectations, but by the desire of enterprises to accumulate resources to pay for imports, but still, the fact remains.

The interest to time ruble deposits goes down

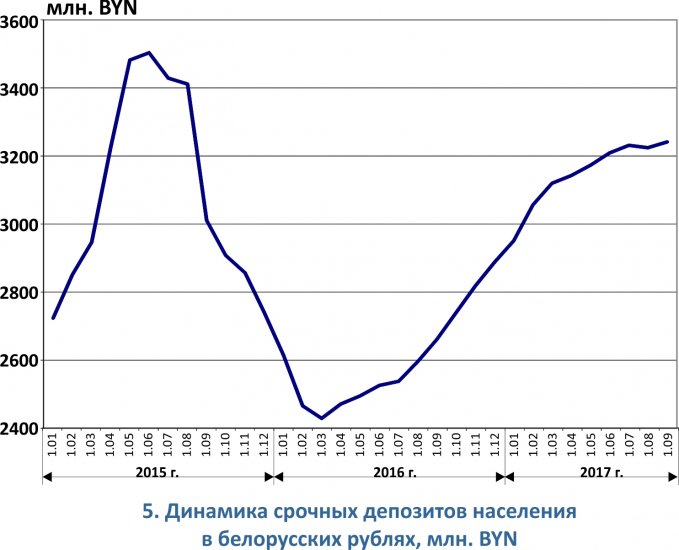

Along with an obvious increase in the propensity of individuals to currency savings, there is a decrease in interest in ruble deposits. During 2017, the growth rates of these deposits fell steadily, and in the last two months of the summer they were at the level of accrued interest on deposits (diagram 5). Thus, the value of time ruble deposits of the population in August increased compared to July by 17.1 million BYN (0.5%) and amounted to 3.241 billion BYN.

However, the scope of the transferable Belarusian ruble deposits of the population has increased since June, but this is clearly related to the increase in wages, which are mainly transferred to bank cards. The population spends this money quickly. In particular, in August the amount of such deposits decreased by 27.4 million BYN (1.5%) as compared to July and amounted to 1.793 billion BYN. This, apparently, is a seasonal reduction associated with preparing for classes in schools.

The legal entities’ interest in time ruble deposits also decreased. The value of these deposits varies greatly from month to month, but on average, since the second quarter of this year, it has stabilized (figure 7). However, in August the value of time deposits increased by BYN 311.8 million (13.3%) to BYN 2.655 billion, but most likely this is explained by seasonal factors (a similar growth was observed in August 2016, and in 2015 the rise of these deposits occurred in September).

The value of transferable Belarusian ruble deposits of enterprises in August stabilized, or rather increased, but only by 15.2 million BYN (0.8%) and reached 1.977 million BYN. A sharp increase in these deposits was observed in the second quarter of 2017, which is most likely caused by an increase in business activity in the country as a whole (diagram 8).

Thus, in general, the situation looks rather hopeless. In recent months there has been a clear increase in interest in foreign currency savings, in the sector of dollar deposits of both the population and enterprises. At the same time, the growth of time ruble deposits slowed down, while the increase in transferable deposits in Belarusian rubles, although it does occur, is clearly explained by the increase in wages of the population and revenues of enterprises.

A light storm should be expected

Of course, the observed processes are explained not only by devaluation expectations, but also by the decrease in the attractiveness of foreign curency and ruble deposits in general in connection with the fall in rates on them, but inflationary expectations, apparently, still take place. And there are grounds for them. First, although the dollar rate has fluctuated in relatively limited boundaries in recent months, the euro and the Russian ruble have reached record levels.

Secondly, the government has not yet explained how it intends to increase the salary in the country to 1 thousand BYN by the end of the year. The people in our country still remember how such attempts ended in the past.

Further events in the deposit market will depend on the actions of the Belarusian government to increase the salary, as well as on the actions of the US government to reform the country's tax system. The latter can cause a jump in the dollar against the euro, which will lead to a sharp increase in the dollar rate at the JCS Belarusian Currency and Stock Exchange (see "VTB 24: the collapse of the euro, which we have been waiting for, has begun"). So it is quite possible that the state of dormancy in the foreign exchange market of the Republic of Belarus in the coming months can be replaced by a light storm, to which the most prudent residents of Belarus are already preparing.