Budget-2018: Predictions and Realities

25- 22.01.2018, 7:56

- 63,616

The government does not assess the situation rationally.

While accepting the state budget both the current economic situation in the country and the government's forecast for the next year are taken into consideration. The analysis of the state budget makes it possible to understand how realistic its indicators for the year 2018 are, Economichescaya Gazeta writes.

Amendments stipulated by corresponding Lukashenka's Decree No. 464 of 27.12.2017 "On Specification of Indicators of the Republican Budget for the Year 2017" provide with a good layout. In fact, the decree sums up the compliance with the state budget for the year 2017. It specifies the explicability of economic forecasts for the year 2018.

Inflated expectations from budget "revenues"

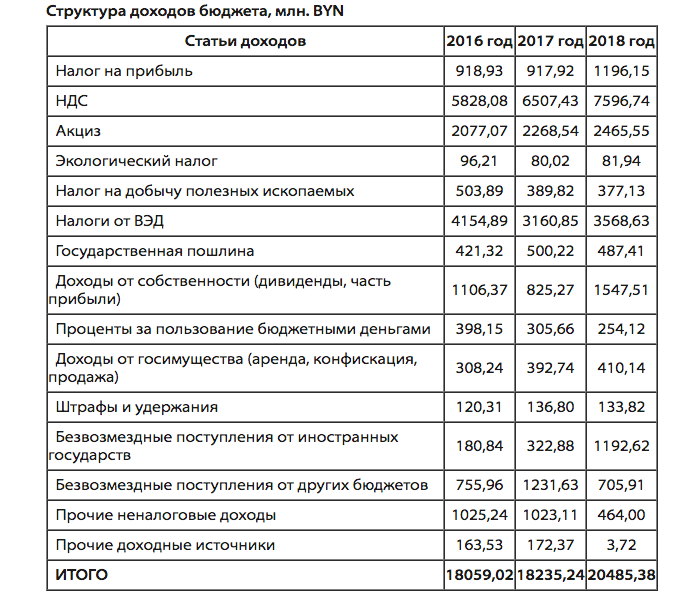

The initial inspection of the income part of the budget for 2018 proves an excessive "optimism". In comparison with 2017 it is planned to "increase" income by 12.3%, or by BYN 2.25 bln.

The main revenue increase is expected through VAT (+ BYN 1.09 bln), uncompensated receipts from foreign countries (+ BYN 0.87 bln), income raised on public property (+ 0.72 bln. BYN), taxes from FEA- foreign-economic activity (+ 0.41 bln. BYN). Every point has substantial and economically reasonable doubts.

First, it's not completely clear how the government is going to take such a substantial VAT increase (16.7%) amid the adopted plan for the year 2017 stipulating VAT reduction by BYN 0.26 bln. That is, failed to ensure the proper level of tax revenue for VAT last year, the state plans to ensure a greater increase in VAT revenue in 2018. How can it be done?

It depends on two factors: imports of goods and domestic trade. Both factors, in turn, depend on the domestic demand generated by the population and business. No forecast of the government implies such an increase either in income of the population or in business. It means that the VAT budget plan is initially irrational and may be achieved through inflation. The current year will show whether the state is ready to sacrifice the financial stability for the nominal budget generation at the expense of VAT.

Second, it's not clear what states are ready to provide Belarus with uncompensated BYN 0.87 bln in 2018. Perhaps, the Ministry of Finance has this information, but most likely it is about inaccuracies and only additional revenues from inter-budgetary transfers of donor districts (Salihorsk, Mozyr, Navapolatsk) are planned. The last option is valid in case of favorable conditions on the world market of potash fertilizers and oil products in 2018.

It is expected that favorable environment will contribute to an additional revenue in the FEA. In particular, it is about the possibility to gain additional customs duties in case of growth of demand for Belarusian potash fertilizers and oil products and possible revival of the Belarusian economy, which lead to the growth of imports, and, accordingly, import customs duties. By the way, the last factor is belived to effect the growth of VAT revenues in 2018.

Only the forecast on growth of proceeds from the public property (dividends, a part of revenue of unitary enterprises) by BYN 0.72 billion is doubtful. It is even more doubtful if we take into consideration the revenue of 2017, which was BYN 0.28 bln. less than in 2016. What will contribute to such a growth this year then? Does the government rely on magic power of Decree No. 7, which aims at a significant increase in profitability of state-owned enterprises? Only the year 2018 will tell.

Undervalued Costs

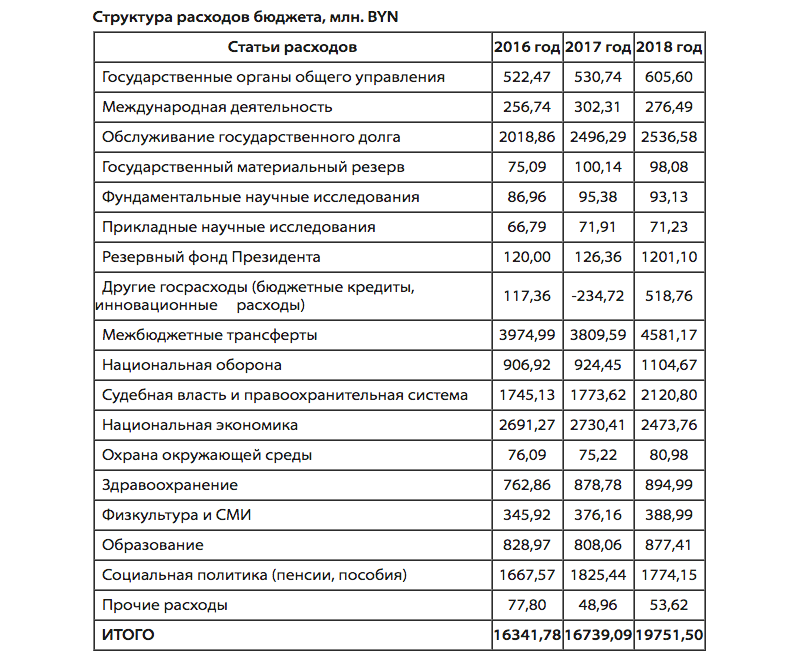

The analysis of the state budget expenditures raises doubts about the validity of calculations under two articles.

First, the state is actually planning to preserve the level of the public debt service expense, although since the beginning of the year and as of December 1, 2017 it grew by BYN 5.3 bln, or by 14%.

Such a significant increase in debt also implies an increase in its service expense, which was is reflected in the budget for 2018. Only further plans of the government on increase or readjustment of the external debt, which can save the budget money in the current year to service the public debt, is the economic justification of this fact.

The planned social policy cuts are the second position in the undervalued costs list. It looks even more strange given only increased expenses in the sphere in recent years. Compared to 2016, in 2017 social spending increased by 0.16 bln. BYN. It's connected with inter-budgetary transfers to the National Social Security Fund (NSSF) to pay pensions. This situation is unlikely to change in the current year, which is indirectly confirmed by Law No. 86-З of 31.12.2017 "On the Republican Budget for the Year 2018" (hereinafter – the Law). Sub-paragraph 1 1.3 of Article 16 establishes the right of the government to transfer to the NSSF additional BYN 0.5 bln.

In this regard, the conflic between planned and actual expenditures can be explained by further reductions in government spending on family support and housing construction. Thus, the Lukashenka's decree cuts social support to families with children (by BYN 15 billion) and housing construction (by BYN 0.03 bln). Judging by the planned budget expenditures, the same practice will remain in 2018.

As for other expenses, it is necessary to pay attention to the planned growth of inter-budgetary transfers (by BYN 0.77 bln). It seems that it is planned to intensify the work on the redistribution of budget expenditures between the regions in order to equalize the economic situation in the country.

The latter, in particular, is related to the expansion of the list of benefits provided to enterprises registered in rural areas. For example, by decree of Lukashenka No 345 of 22.09.2017 "On Development of Trade, Public Catering and Social Services." The expansion of the list of benefits reduces revenues to local budgets, which are likely to be offset by the republican budget.

It is expected that expenditures for the national economy will grow by BYN 0.5 bln. In this case, both direct expenses for the national economy and expenses for other public activities are taken into account. The latter includes costs for budget loans, costs for innovative funds.

In economic terms, these costs are the veiled way to support state-owned enterprises and, therefore, are spent on the national economy. It seems that the government does not expect a significant improvement in the economic situation of enterprises, which once again confirms the doubt about the possibility to achieve growth in earnings from the state property, as specified above.

The analysis of the structure of the republican budget for 2018 once again shows weak points of the state planning, based on excessive optimism, both in the planning of revenue and expenditure parts of the budget. While planning the revenue part of the budget, in a greater degree the state hopes for domestic demand and favorable environment on foreign markets; and while planning the area of expense, it hopes for less expenses, than, most likely, our economy requires.

In general, once again the budget of 2018 proves the persistent economic policy of the government, which is not ready for a real assessment of the budget, and, therefore, the analysis of the real economic situation in the country.