Sanctions Are Approaching: Will Belarusians Have Time to Save Their Foreign Currency Deposits?

17- 18.05.2021, 13:39

- 21,920

The country is approaching the financial "Rubicon."

The dynamics of individuals' deposits in foreign currency is a good indicator of the attitude of the population to the financial and banking system, to its reliability and stability, as well as confidence that people's foreign exchange savings will not be lost (they will not be frozen or converted into rubles) due to the lack of the required amount of currency in the country, infobank.by writes.

This national currency can always be printed in the required amount and refinanced by banks, not allowing any default on liabilities in Belarusian rubles, even at the time of massive withdrawal of deposits. Therefore, the only fears that people have here are exclusively devaluation ones.

And you can't print dollars and euros. They can either be earned through foreign economic activity or borrowed - to attract money from outside in the form of loans or, much better, foreign investment.

Borrowing money abroad has now become difficult - for political reasons. And the investment climate in Belarus seems to be lacking as such.

The dollars that come to the country with a positive foreign trade balance are not enough given the huge external debt of Belarus. This year, it (external debt) is breaking historical records, its service wasting large amounts of currency out of the country. Accordingly, the default risk, which until recently was negligible, now no longer seems so.

And, with the introduction of another package of sanctions against Belneftekhim, which threatens with shocks in the export of goods from the petrochemical complex (which brings the most foreign currency to the country), default risks will multiply.

On the other hand, as we can see, Russia is in no hurry to finance the Belarusian economic model under the sanctions, and there is even a threat of a significant reduction in Russian oil supplies to Belarus. Azerbaijan has already refused.

All this, if it goes according to the worst scenario, threatens big problems with foreign exchange in Belarus and not only that. In confirmation of the impending serious threat, we see more frequent meetings at the highest level of Belarus and Russia.

Against such an information background, the dynamics in the foreign sector of individuals' deposits are expected: foreign currency depositors' fears of “default” - and they cannot have other fears - result in the removal of fixed-term foreign currency deposits by the population.

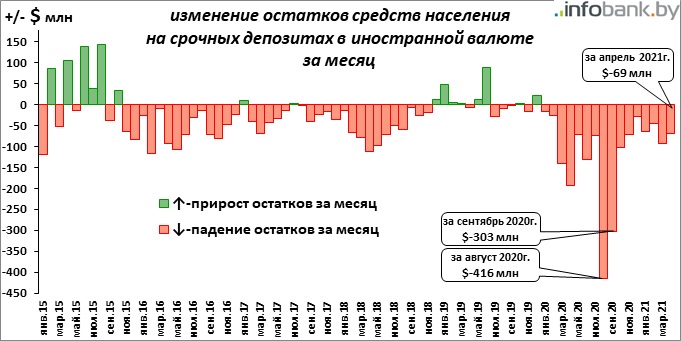

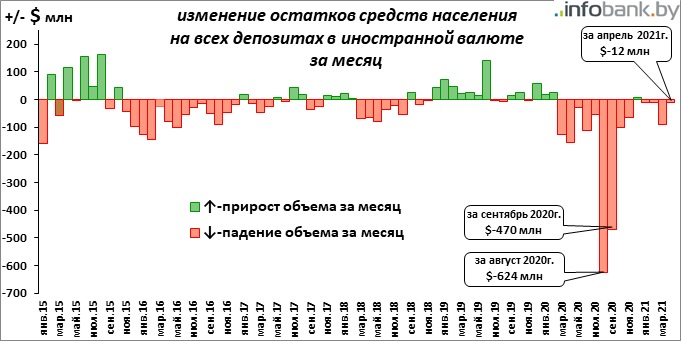

The slight dynamics began in January 2020, then increased sharply against the background of the coronavirus crisis. The process could have ended in the autumn-winter of the same year, if not for the political crisis that broke out after the presidential elections and not for its continuation in the form of a severe deterioration in foreign relations.

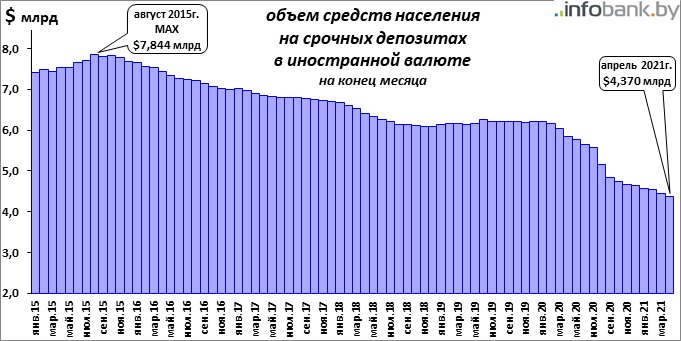

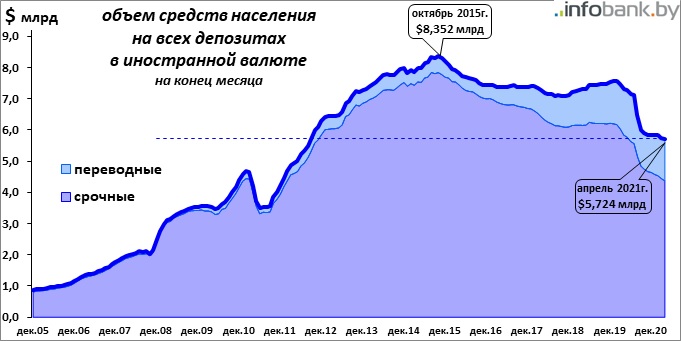

Thus, the reduction in the balances of fixed-term deposits of individuals in foreign currency lasts continuously for 16 months, and the net outflow during this time has already amounted to $ 1.846 billion, which is more than was taken out in total for 3 years during the crisis of 2015-18.

In April 2021, the outflow amounted to $ 69 million: this is how people took out more currencies from time deposits than they made (besides, about $ 6-7 million in this amount is the capitalization of accrued interest on the deposit, not physical income).

The amount of funds of the population on fixed-term foreign currency deposits of individuals in foreign currency was $ 4.429 billion at the end of April. This is a minimum in 9 years, since the beginning of 2012.

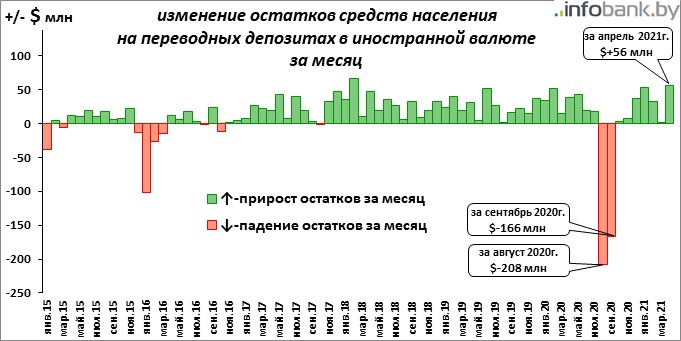

However, in April, on the contrary, an increase on the transferable deposits of individuals in foreign currency - on the currency card accounts of the population - was recorded, which is the largest in more than 3 years - by $ 56 million, which, in many respects, is the result of a significant purchase ($ 236 million) non-cash currency by the population this month.

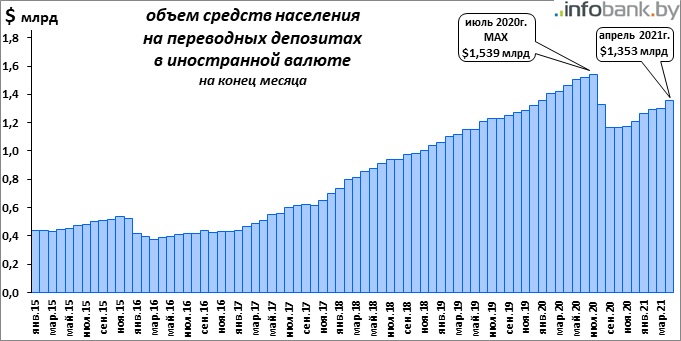

In the transfer sector, the dynamics of the volume of household deposits have always been better than in the fixed-term sector: the profitability in both cases is scanty. It's greater on term deposits, but the percentage is such that it does not matter. Both term and transferable - both types of deposits - are used more for safe and “anti-devaluation” storage of savings.

But on the cards, access to money is prompt and is possible in another country. It is convenient and profitable. Therefore, the storage of money on transferable currency card accounts in recent years has become very popular, the volumes of such deposits have grown from month to month, updating their historical records, and fell only in times of crisis.

They have been growing continuously for the last 7 months: the efficiency of access to foreign currency savings, the possibility of their quick withdrawal to the cash in case of "if something" comes to the fore. And this is another indicator of the decline in confidence in the domestic financial and banking system.

But still, the total increase in the balances of funds of the population on transferable foreign currency deposits over the seven "plus" months - $ 189 million - is less than the take-out in one month in August or September 2020.

Therefore, at such a pace, a return to the previous, pre-crisis level will take a lot of time: their largest volume was recorded at the end of July 2020 - $ 1.539 billion, and now, at the end of April 2021, it's $ 1.353 billion.

The outflow of foreign currency from term deposits of individuals in April turned out to be more than the inflow of foreign currency to card accounts of the population by only $ 12 million - this is the overall decline in the amount of deposits in foreign currency in the banking system this month, but this is the fourth consecutive decline.

And, in total, this outflow has been going on for more than a year: it all started in March 2020 due to fears associated with the outbreak of the global corona crisis, and, over the past 14 months, there has been an increase in only one month - in December.

In total, over the past 14 months (since March 2020), the amount of transferable and term deposits of individuals in foreign currency decreased by $ 1.856 billion and amounted to $ 5.724 billion at the end of April 2021. This is a minimum of 8.5 years.

Note that a decrease is also taking place in the national sector of deposits, which means that there is no flow of money from foreign currency deposits to BYN-ruble deposits: currency from deposits goes into cash dollars and euros, reducing the volume of foreign exchange assets of the banking system.

If panic suddenly arises, as was the case in August-September 2020, when in two months the population withdrew almost $ 1.1 billion from banks (see the diagram above), this amount can be a serious problem.

If a year ago it was possible to “flood the fire” with money borrowed from outside, now, in the context of the sanctions restrictions on external borrowing and limited Russian support, money will have to be taken only from our own foreign exchange reserves.

Which may not be enough, given the total volume - $ 11 billion - of liabilities of the banking system of Belarus in foreign currency, including $ 5.724 billion - to the population.

There is a likelihood of such panic if the announced new package of sanctions, which comes into force on June 3, turns out to be as destructive as it is presented.

If after June 3 Belarus will not be able to find a trick on how to export petrochemicals, then the time to save foreign currency deposits will indeed be severely limited - in such conditions, problems with the foreign exchange may begin in the country.

However, all these fears may turn out to be in vain if Belarus manages to place bonds in Russia for 100 billion Russian rubles. This is equivalent to $ 1.4 billion, and this amount is quite enough to maintain financial stability and forestall panic.

In today's political conditions in Belarus, Russian placement also looks like an equation with many variables. On the one hand, Russians are unlikely to take such a risk. However, if the Russian leadership “recommends” buying Belarusian bonds, for example, by distributing them little by little to a large number of market participants, the placement may turn out to be successful, and the problem will be resolved.

It turns out that, with the approach of sanctions, Belarus is approaching a certain Rubicon, after which little depends on it. External circumstances will have a much greater impact: how destructive these sanctions will turn out to be, and whether the top leadership of Russia will support the placement of bonds by Belarus for the declared amount.