Western Banks Close Foreign Currency Accounts In Belarusbank, Belagroprombank, Belinvestbank

16- 13.09.2021, 13:33

- 66,566

This will hit the regime's income badly.

As nn.by has learnt, last week the main correspondent bank of the Belarusian state banks, Deutschebank, closed its correspondent accounts in euros. According to the sources, other foreign banks have done the same. Earlier Belinvestbank, Belarusbank and Belagroprombank fell under the EU sanctions.

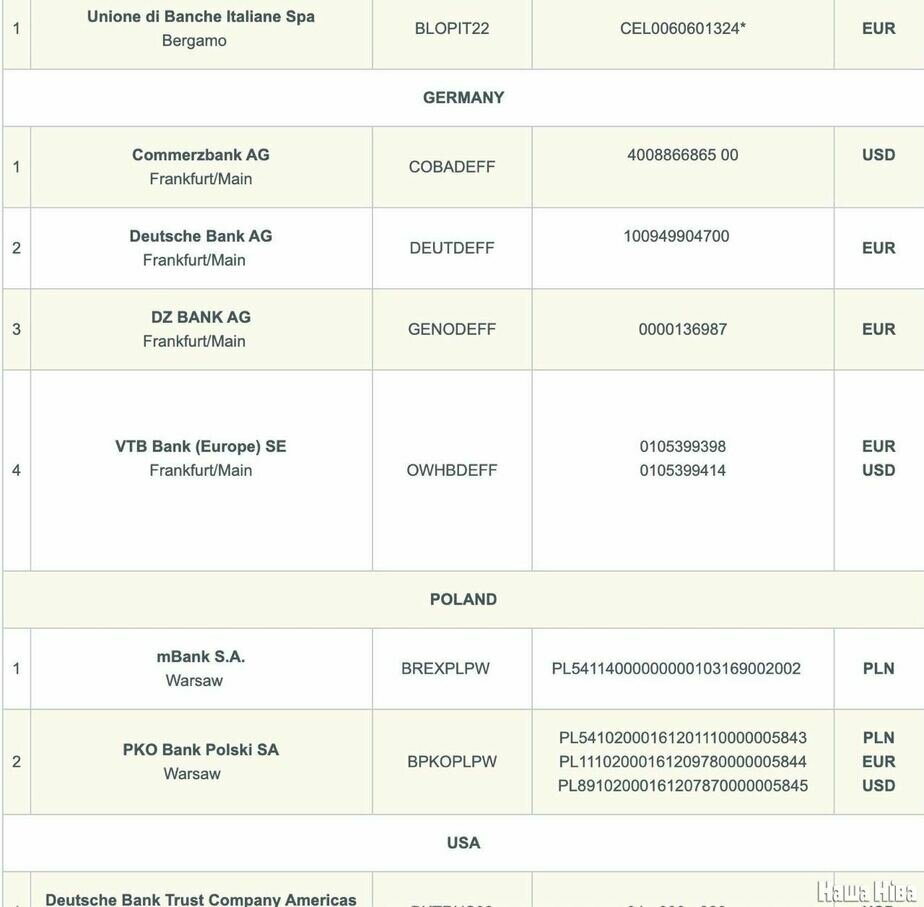

In open sources, you can see the situation, for example, in Belagroprombank.

It looks bleak: the possibility of currency transactions remains only through small Belarusian banks, as well as the Russian TKB Bank, which, according to the local Forbes, ranks 87th in the rating of the Russian banks reliability.

And here, for example, how the situation looked a few years ago, according to the cache of the same web page.

Currency transactions could be made through a variety of European correspondents, from Italian and Polish to American.

Among the Russian partners on the list were the giants Sberbank, Rosselkhozbank, VTB and Rosbank. Now they are not on the list of correspondents either.

According to our information, a similar situation has developed in Belarusbank and Belinvestbank. In Belarusbank, transfers in euros are still possible through the European subsidiary of VTB Bank.

Economist: consequences - loss of income

What does this mean? As economist Dzmitry Kruk explains, in the modern world, a bank without correspondent accounts in dollars and euros in the US and eurozone banks is considered defective, and this entails consequences.

“Through the bank's correspondent accounts, the movement of clients' funds occurs: payments by legal entities under export-import and financial contracts, as well as numerous payments by individuals (but this does not directly apply to retail payments through card systems).

A bank that is unable to meet these almost daily needs of customers automatically loses the corresponding fee and commission income from the organization of international settlements.

In the vast majority of cases, the corresponding fee and commission income does not represent a very significant part of the bank's total income. But even if their share is up to 5% of the total, it is still noticeable. Such income is “easy”, since banks in such cases take almost no risk (compare with income from deposits). This is an automatic and obvious consequence, but far from the most important.

Logically, clients from such impotent banks would go to competitors (if they are free to choose, government organizations, for example, cannot), since settlements through such banks will become more expensive and slower, with additional risks.

Finally, many people today acknowledge that the area of payments has become strategic for the development of the banking business.

Through it, big data is collected (a huge amount of all kinds of information - edit.), It allows one to create new product lines. In this sense, active participation in settlement is an important foundation for financial innovation. A bank that cannot carry those out will live in yesterday, think not about development, but about survival,” says Kruk.

Businessman: Entrepreneurs will flee such banks

One of the businessmen said that the movement of currency is technically possible through “small airfields” in the form of small Belarusian and marginal Russian banks, but this all makes it very difficult to fulfill existing contracts, and jeopardizes new ones: they say, entrepreneurs will flee from these banks.

“Previously, a delay in payment for three days was considered a scandal, now two weeks is already the norm, because money travels halfway around the world to get where it needs to be.

European partners very often do not ship goods until they see the money, as a result, you lose contracts or get out of agreement.

I think the private sector, when it fully understands that this is not a temporary problem, will move to other banks or look for opportunities to settle through banks in neighboring countries,” the businessman said.