Belarusian Taxation System Is Most Complicated Among Neighboring Countries

12- 23.11.2017, 17:20

- 19,133

Belarus' neighbors occupy more preferable positions in the tax rating.

It is stated in the report of the audit company PricewaterhouseCoopers on the results of a global study conducted by the World Bank Group and the PwC tax system in 190 countries, thinktanks.by writes.

Belarus' neighbors’ ranking is more preferable. Latvia was on the 13th place, Lithuania – on the 18th, Ukraine – on the 43rd, Poland – on the 51st, and Russia – on 52nd place in the Paying Taxes ranking.

At that, the number of tax payments is relatively small in Belarus. It amounts to 7. In the European Union this figure is 12, in Eastern Europe and Central Asia – 16.2, in the world – 24.

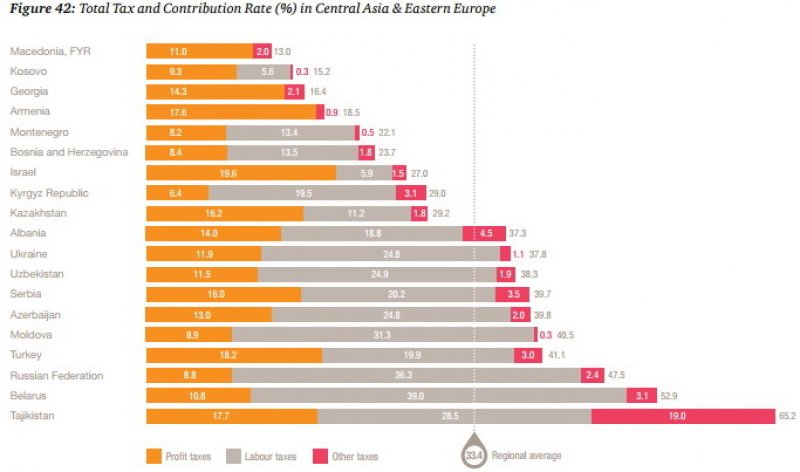

But the average effective tax rate from profits to taxation is 52.9%, while it is 39.6% in the EU, and the world average is 40.5%. As for this indicator, Belarus occupies the next-to-last place in the region of Eastern Europe and Central Asia. Tajikistan turned out to be the last one, with an indicator of 65.2%.

The study Taxation 2018 is one of the components of the World Bank study Doing Business 2018.

In Taxation 2018, all the mandatory taxes and fees that the company (as a medium business representative) has to pay during the relevant year, as well as the practical aspects of such payment, are analyzed.

The analyzed taxes and fees include, in particular, the corporate income tax, social insurance fees and salary taxes, property taxes, and other taxes applicable to a medium-sized company in each country.

PwC has been participating in the preparation of the study on a pro-bono basis over the past 12 years.