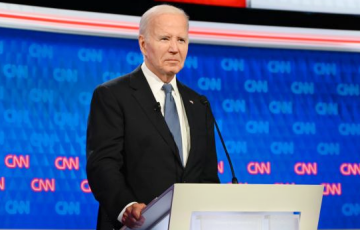

Biden's Withdrawal From Presidential Race: What Awaits Global Markets

2- 24.07.2024, 8:31

- 6,800

The US President's decision has caused a significant resonance.

The unexpected decision of US President Joe Biden to withdraw his candidacy from the 2024 presidential election has caused a significant resonance in global financial markets.

RBC-Ukraine investigated how Joe Biden's withdrawal from the presidential race will affect global markets.

On July 21, US President Joe Biden officially announced his decision to withdraw his candidacy from the 2024 presidential election. The reaction of financial markets to this announcement was mixed.

On the one hand, this created uncertainty in the markets. Oleksandr Martynenko, Head of the Corporate Analysis Department of the ICU Group, believes that the increase in Donald Trump's chances of winning has worsened estimates of how the price level for goods and services will change over time.

On the other hand, some markets calmed down after the announcement. Taras Kozak, President of the UNIVER investment group, says that no extraordinary events occurred on July 22, the first trading day after this statement. In terms of the real impact that we can observe, the general trend was for cryptocurrency to grow, but then quickly leveled off to previous levels.

Biden's exit from the race has brought additional uncertainty to global financial markets, which are now forced to assess the consequences of Trump's potential victory and the impact of his policies on the economy.

The assassination attempt on US presidential candidate Donald Trump, according to investors, has significantly increased his chances of winning the election, notes Oleksandr Martynenko. Accordingly, expectations have increased that the new presidential administration could provoke greater inflation due to tax cuts and higher import tariffs.

According to RBC-Ukraine's interlocutor, the expectation of a reduction in Fed rates, a slowdown in inflation, and the stability of the US economy have increased optimism in the stock markets. Retail sales in the US exceeded economists' expectations.

At the same time, there was an outflow of capital from shares of large technology companies to riskier shares of companies with small market capitalization. This led to a weekly decline in major US stock indices such as the S&P 500 and Nasdaq Composite. European and global indices, including the Stoxx 600 and All-World FTSE, also suffered.

International corporate finance consultant Ivan Kompan says that markets are generally reacting positively to events in the US. However, this will not affect the Ukrainian currency market in any way.

“This should not affect the hryvnia exchange rate in any way, because it is controlled and flexible. Everything depends on foreign assistance from our allies. Also, we are in for some difficult times, because inflation will return. And this affects the possible devaluation of the hryvnia. But given that the market is controlled by the national bank, there should be no catastrophe,” Ivan Kompan believes.