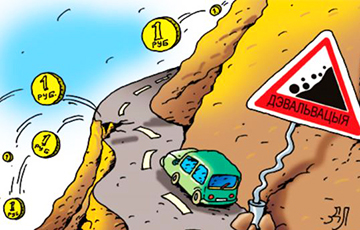

Ruble Faces Serious Devaluation

23- 22.05.2017, 8:21

- 18,847

The expected downfall in the exchange rate of the Russian currency will bring down the Belarusian one as well.

The Russian authorities allow the devaluation of the Russian ruble within a year to the level of RUR 68 for 1 USD. How much in this case can the exchange rate of the Belarusian ruble fall? Analyst of the BusinessForecast.by research group, economist Alexander Mukha contemplates on this on the website "Our opinion":

- Considering that the official exchange rate of the Russian ruble to the US dollar on May 20 of this year was 57,1602 RUR for USD 1, the expected devaluation of the Russian ruble is estimated at about 19%. It is not excluded that the devaluation of the Russian ruble, among other things, will be associated with an increase in the money supply in order to finance infrastructure projects in the Russian Far East.

It should be noted that the devaluation of the Russian ruble could lead to a drop in exports of the Belarusian goods and services to Russia while increasing imports of the Russian goods and services to Belarus. As a consequence, in this case, the balance of foreign trade with Russia could worsen with all the ensuing negative consequences.

On the other hand, in the current situation, the real effective exchange rate of the Belarusian ruble against the Russian ruble, according to our estimates, looks understated. Therefore, with a 19% devaluation of the Russian ruble against the US dollar, the devaluation of the Belarusian ruble against the US currency within the framework of the baseline scenario could be about 12% (all other things being equal).

In this case, the undervalued real effective exchange rate of the national currency is used to stimulate exports and simultaneously limit imports. By the way, according to Belstat, the export of Belarusian goods to Russia in the first quarter of 2017 increased by 37,9% to $ 2,813 billion compared to the same period of the previous year.

At the same time, the main risks to the stability of the domestic foreign exchange market in Belarus are related to other external and internal factors. Among them, the expected decrease in the supply of foreign currency from the population, the preservation of significant payments for the external debt of residents of Belarus in the conditions of chronic shortage of gold and foreign exchange reserves, lower interest rates for ruble instruments, increased social stratification in the society etc.

According to the National Bank of Belarus, in January 2016 - April 2017, individuals sold on a net basis $ 2,611 billion (including non-cash transactions). According to BusinessForecast.by, the population in January 2016-April 2017 was forced to part with at least a third of the accumulated currency savings in unorganized form. As a result, while maintaining such rates, the unorganized currency savings of individuals can hypothetically end in less than two years (with other things being equal).

In turn, the schedule of forthcoming payments on gross external debt of residents of Belarus as of January 1, 2017 includes payments on principal and interest for a total amount of $ 45,651 billion.

In 2017 payments of residents of Belarus on foreign debt are estimated at $ 17,168 billion (including refinancing operations). As of January 1, 2017, Belarus's foreign exchange reserves totaled $ 4,927 billion, covering only 28,7% of the forthcoming payments on external debt. While, according to the Gidotti criterion, the gold and foreign currency reserves should cover not less than 100% of the forthcoming annual payments for the aggregate external debt of the residents of the country (government, central bank, enterprises, banks).

As a result, in case of a negative scenario, the rate of devaluation of the Belarusian ruble against the US dollar in the coming year may exceed the expected rate of devaluation of the Russian ruble against the US currency by at least several percentage points. Accordingly, in this case, the real effective exchange rate of the Belarusian ruble will continue to be underestimated to the Russian ruble due to the lack of the ability of the central bank of Belarus to support the national currency due to the lack of the country's gold and currency reserves.